When it comes to personal finance..... be active not passive.

During the first lockdown of Covid I (and many others) discovered the concept of FIRE (Financial Independence Retire Early). The basic idea of FIRE is simple: make enough income from investments to cover your expenditures and you will never 'have' to work again. Usually this translates into having a net worth of 25x your annual expenses and being able to live off 4% of the investment income.

The concept is beautiful. When you no longer have to work for money, you can use your time more effectively and enjoyably. The execution is more difficult. It usually requires a net worth of $1 million or more in order to live comfortably, and if it was that easy to make passive income then many more people would be retiring early.

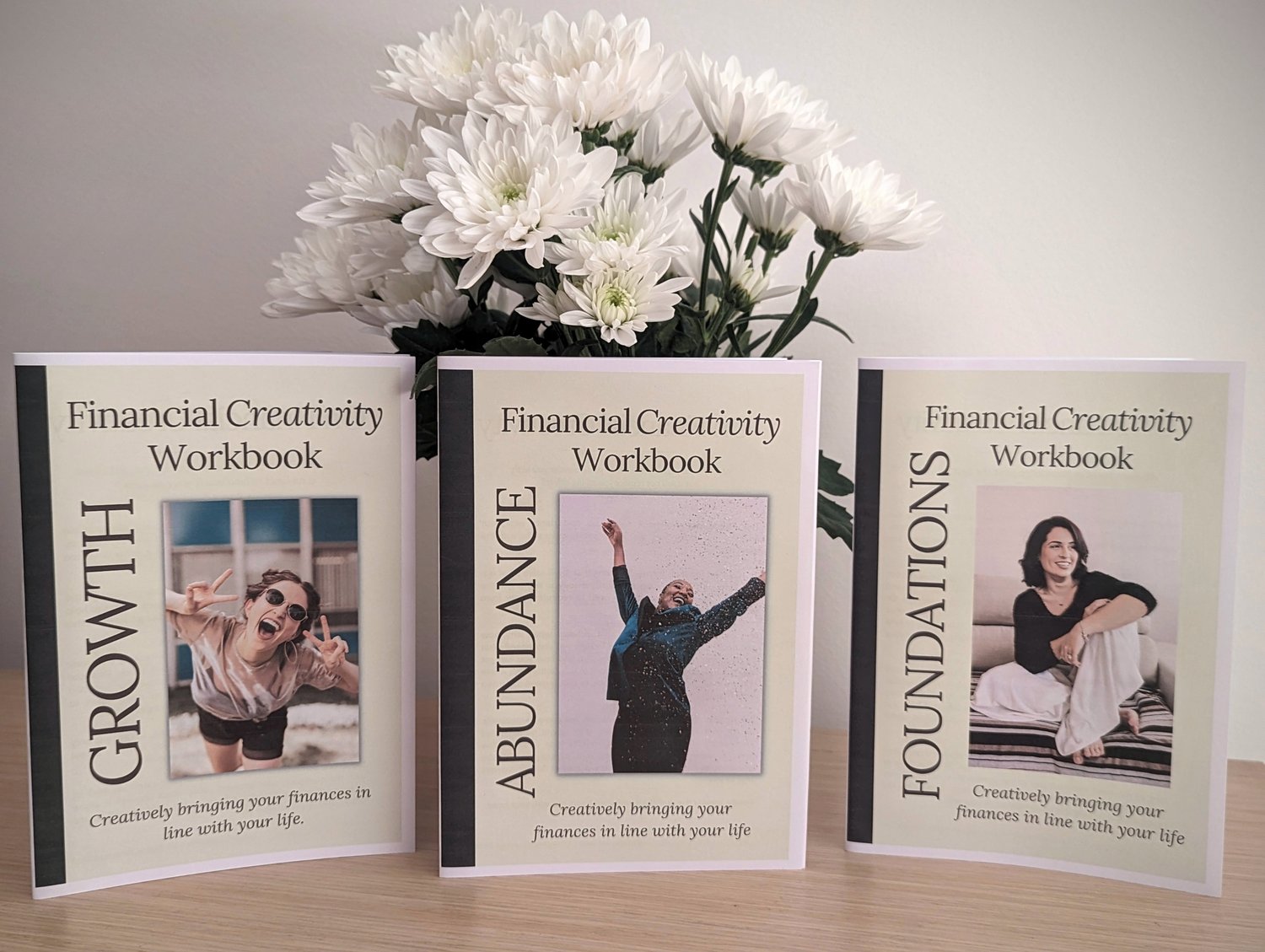

Foundations

The steps to take at the start of any FIRE journey are simple - clear debt, control spending, cut costs, save, and invest. These are the foundations to any one getting control of their money. I even created a free foundations workbook to cover the basics and get people started. There are also many books, YouTube videos, articles and Instagram accounts available online that share knowledge and practical steps, and I share some of the best ones in the workbook. In fact, the foundations of personal finance have been extensively written about.

After 6-12 months of focus on the foundations you can be in a good place with your money, and this is where it becomes more difficult.

Growth

The second stage towards FIRE is Growth. Counting pennies and saving part of your pay check every month isn't going to get you quickly to early retirement. Instead you need to make smarter decisions, strategic investments and know exactly what you are aiming for in order to grow your finances faster.

The growth stage is about formulating a plan to get you to where you want to go and then sticking to it. Searching for information not as important as setting the direction yourself. And while there is a strong tendency to copy others who are ahead of you, but this is only useful if they are where you want to go. In fact many people have been hit recently with financial market dips and inflation because the people who FIRE'd in past years did so in different conditions. If you are clear with your direction and have a strong plan, these things wouldn't hit so hard.

It's also important to understand that the successful people we see today became successful in a different period of time to you. Many Londoners who bought a house 10-20 years ago have seen the value of the property triple, and they likely bought second or third homes to compound that growth. Someone living in London today cannot repeat this growth and so needs the skills to be creative with their path and find opportunity elsewhere instead of copying what was done before.

Financial Creativity

This leads me to the concept of financial creativity. This concept is a mindset that allows you to look at different ideas, successes and suggestions and then consider them in relation to your own life. Buying a property in London today - not a great idea. Buying assets that are likely appreciate because the city is in demand - good idea. Creatively searching out places where this idea could happen and looking at the risk and reward, and how this could benefit your life - great idea!

The quote about "if millionaires started from scratch with $0, by the end of 5 years they'd be millionaires again" highlights that creativity (coupled with a work ethic) is what makes people rich, not just saving money and investing in index funds.

I created the Growth workbook to get people thinking about how they can grow their wealth and what would work for them in the context of their own lives. Instead of passively copying, I want people to start thinking and creating for themselves. The workbook helps people identify what they are actually working towards so that they can get there faster. It also allows people to think creatively for ideas to make more money while working towards other life goals.

The more creative people are, the more opportunities they will see, and the faster they can achieve their goals!

Abundance

Finally, there comes a stage in the journey to FIRE where money becomes less important and time becomes more important. It's where you can start to look at other areas of your life instead of just your net worth, and take stock of projects, hobbies, health and family. You have enough money to not worry (although maybe not enough to retire early), and what you really want to feel is abundance.

Abundance is having more than enough - your cup is overflowing - yet often when we judge progress against our FIRE number we may feel a sense of lack. If we are able to put our finance independence plans to the background then you can start to redirect your time and energy to other projects that bring you joy, fun, excitement, peace and serenity.

The final workbook in the Financial Creativity Trilogy is about exactly this - how to feel abundance focusing on the reasons you wanted to retire early in the first place.

The abundance workbook guides you through important life questions, and asks you to answer them from the heart. It allows you to consider what your best life would look like; your rich life, your abundant life.

The most important aspect of all the workbooks is that the answers come from within. The answers are generated by you, not from someone outside, and this strengthens your financial creativity muscle and allows you to cultivate ideas and investments that truly fit towards what you want.

Financial independence is a worthy goal, but financial creativity will truly allow you to identify and create your rich life today, not at some point in the future.

All workbooks can be downloaded at giftofayear.com (use RICH20 for a 20% discount).